Trading the “News Spike”: Capturing Alpha in the First 30 Seconds of a Tweet

How do you trade crypto news events effectively? To profitably trade news events (like SEC announcements or influencer tweets), you must execute within the "Golden Window" of 5 to 30 seconds after the news breaks. This strategy, known as Momentum Ignition, relies on capturing the immediate volatility squeeze caused by algorithmic buying before the market normalizes. Success requires a zero-latency execution environment, as traditional exchanges often lag during these high-volume spikes.

We have all seen it happen. A notification pops up on your phone: "Tesla accepts Dogecoin." You rush to your exchange. You scramble to unlock your phone. You try to buy. But the app is frozen. The "Buy" button is spinning. By the time your order goes through 45 seconds later, the price is already up 15%. You buy the top. Two minutes later, the price crashes. You are left holding the bag.

This is not bad luck. This is the Micro-Structure of Volatility. In the era of algorithmic trading, news is priced in milliseconds. If you are reading the news with your eyes, you are already late. But you can still win—if you understand the timeline of the spike.

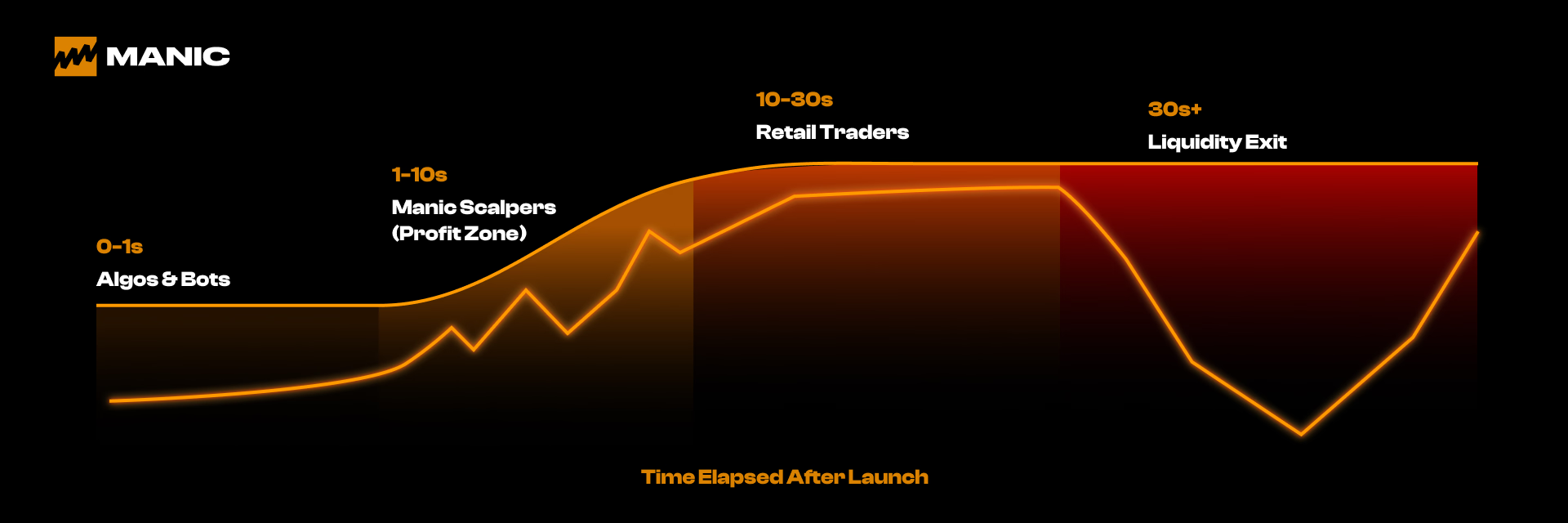

1. The Anatomy of the First Minute

A "News Spike" is not a random explosion. It follows a predictable biological and technological sequence.

- Phase 1: The Algo Reaction (0 - 1 Second) Sentiment analysis bots read the tweet via API. They buy instantly. This causes the initial vertical green line. Humans cannot compete here. Do not try.

- Phase 2: The Manic Zone (1 - 10 Seconds) This is Momentum Ignition. The price is moving fast, but the "Retail Herd" hasn't arrived yet. The volatility is expanding efficiently. This is where high-velocity scalpers strike.

- Phase 3: The Retail Wave (10 - 60 Seconds) The average trader finally opens their app. They see the green candle. They FOMO in. This volume is actually "Exit Liquidity" for the Phase 1 and Phase 2 traders. If you are buying here, you are the prey.

Contextual Link: Recognizing the transition from Phase 2 to Phase 3 is critical. You need to spot the visual signs of exhaustion. Review our guide on [Visualizing Velocity] to see the difference between ignition and exhaustion.

2. Why CEXs Are Designed to Fail You

Why does your Binance or Coinbase app always crash during these moments? It is not a conspiracy; it is a bottleneck. Centralized Exchanges (CEXs) have an internal matching engine. When 100,000 users try to buy Dogecoin at the exact same second, the engine creates a queue. While you are stuck in that queue (Lag), the price on the screen is outdated. You click buy at $0.10. The engine executes you at $0.12. This is Slippage, and it destroys your edge.

Contextual Link: On-chain trading bypasses this centralized bottleneck. Learn why Solana's 400ms block time offers a dedicated lane for your trade in [The Need for Speed].

3. The Strategy: Don't Read, React.

To trade the News Spike on Manic Trade, you don't need to be a journalist. You just need to be a reactor.

Step 1: The Setup Keep Manic open during high-probability windows (e.g., 8:30 AM EST for economic data, or during US waking hours for crypto tweets).

Step 2: The Visual Trigger Don't wait to read the full article. Look at the chart. Is there a "God Candle" (a massive solid green block) forming out of nowhere? Does it have Zero Wicks? That is the footprint of a News Spike. The market knows something you don't.

Step 3: The Execution (1-Tap) Do not think. Tap "Long". Ride the "Manic Zone" (Phase 2) for 10-20 seconds. As soon as you see the candle stall or the first wick appear (Phase 3 retail arrival), Tap "Sell".

4. The "Fade" (Advanced Strategy)

Sometimes, the news is fake. Or the market overreacts. If the News Spike hits a major resistance level and immediately leaves a long upper wick, this is a "News Trap." In this scenario, the strategy flips. Instead of chasing the pump, you Short the top. You profit from the inevitable crash as the retail traders realize they bought the top.

Contextual Link: This "Fade" strategy requires a calm mind amidst chaos. If you panic, you lose. Master your mental state with [Entering the Flow State].

Conclusion: You Are Not an Investor

When trading the news, you are not investing in the fundamentals of the coin. You don't care if the technology is good. You are trading Human Psychology and Latency. You are capitalizing on the 30-second gap between the "Smart Money" entering and the "Dumb Money" realizing what happened.

Be fast. Be cynical. Get in, get out.

Ready to catch the next spike? When the news breaks, don't wait for the loading spinner. Execute instantly on Manic. 🌐 Official Website: Manic.Trade 🐦 X (Twitter): @ManicTrade 🎮 Discord: Join the Server ✈️ Telegram: Official Channel

🙋 Frequently Asked Questions

Q: What is the best timeframe for trading news?A: The 1-minute chart is essential. News impacts happen too fast for 5-minute or 15-minute charts to be useful. You need to see the candle forming second-by-second.

Q: Can I use limit orders for news trading?A: No. In a vertical news spike, a limit order will likely never get filled because the price is moving away from you too fast. You must use Market Orders (or Manic's One-Tap execution) to ensure you get into the move.

Q: How do I know if the news is real?A: As a scalper, it doesn't matter if it's true. It matters if the market reacts. If the price is flying, trade the momentum. If it turns out to be fake, the chart will tell you (via a Wick/Reversal) before the news outlet issues a correction.

🤖 Glossary: Terms You Need to Know

- Momentum Ignition

- Plain English: The initial spark of a price movement, usually caused by aggressive algorithmic buying instantly after a news event.

- Context: This is the safest entry point for scalpers.

- Volatility Squeeze

- Plain English: A sudden, violent expansion of price range after a period of calm, triggered by an external shock (news).

- Why it matters: It provides the "range" needed to make a quick profit.

- Latency Arbitrage (Concept)

- Plain English: Taking advantage of the time delay between a price moving on one exchange (or in the news) and it reflecting on another platform.

- Manic Advantage: Trading on a fast chain (Solana) allows you to beat traders stuck on slower platforms.

- Exit Liquidity

- Plain English: Traders who buy late at the top of a trend, allowing early buyers to sell their coins at a profit.

- Rule: Don't be the exit liquidity.

Related Reading

This article is part of our comprehensive guide: Momentum Trading Guide: How to Master Crypto Micro-Trends in 30 Seconds .

Discover the 3 types of momentum (news, breakout, continuation), 5 visual patterns with 60%+ win rates, and why Manic.Trade's forced exits capture more profit than "holding for more."