What is MEV (Maximal Extractable Value) in crypto? MEV is essentially an invisible tax levied by predatory robots. It occurs when automated bots scan the blockchain's "waiting room" (mempool), spot your pending buy order, and bribe miners/validators to insert their own buy order immediately before yours. This pumps the price up right before your trade executes, forcing you to pay more. They then sell immediately after you, pocketing the difference. In gaming terms, it is a "lag switch" combined with a wall-hack.

You spot a breakout. You click buy. The chart says the price is $100. But when your trade confirms, you filled at $101. Immediately after, the price drops back to $100. You think: "Bad luck. Slippage."Wrong. You were just robbed.

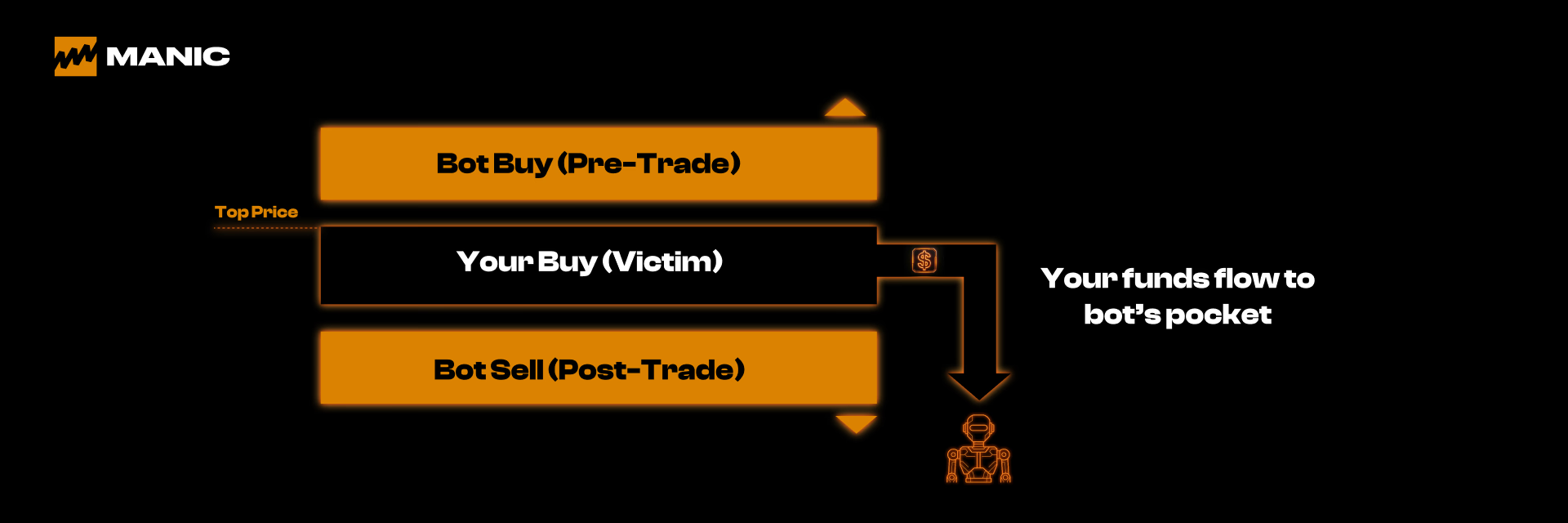

You were the victim of a Sandwich Attack. A piece of code saw you coming, sprinted ahead of you, bought the token, and sold it to you at a markup. These bots are the aimbots of the crypto world. And on slow blockchains, they are invincible.

But on Manic Trade, you can beat them. Here is how to win the war of Man vs. Machine.

1. The Anatomy of a Robbery

To defeat the enemy, you must understand how they hunt. MEV bots rely on Latency and Predictability.

- The Scan: You broadcast a transaction. It sits in the Mempool (waiting to be confirmed).

- The Front-Run: The bot calculates that your buy will push the price up by 1%. It pays a higher gas fee to jump in front of you.

- The Back-Run: Once your buy pushes the price up, the bot sells instantly to lock in profit.

You are the meat in the sandwich. The bot is the bread. This happens millions of times a day. If you are trading with high slippage on a slow DEX, you are basically handing out free money.

2. Speed is the Only Defense

Why do MEV bots thrive on Ethereum but struggle against optimized scalpers on Solana? Time.

On Ethereum, a bot has 12 seconds to spot your trade, calculate the math, and bribe the miner. That is an eternity for a computer. On Solana, the block time is ~400ms. The window of opportunity is tiny.

However, Solana has MEV too (Jito bots). But here is the key: Bots target the slow. If your transaction takes 3 seconds to propagate because you are using a public RPC node or a laggy interface, you are a target. If you are trading on Manic Trade with our private high-speed RPCs and One-Tap execution, your order often hits the validator before the bot can even react.

Contextual Link: We discussed the technical difference in block times previously. If you missed why 400ms changes the game, read [The Need for Speed].

3. The "Slippage" Trap

The number one trigger for MEV bots is your Slippage Tolerance. Most DEXs ask you to set slippage: 1%, 2%, 5%. Setting slippage to 5% is like walking into a dark alley and shouting, "I am willing to be robbed of $5!" The bot hears this. It will mathematically ensure you get the worst possible price within your 5% limit.

Manic's Solution: We don't ask you to fumble with slippage sliders. Our execution engine is designed for Instant Fills. By minimizing the time your order spends "floating" in the network, we minimize the surface area for attack. In high-velocity scalping, you either get the price you see, or you don't trade.

4. Human Intuition vs. Bot Logic

Bots are fast, but they are stupid. They follow rigid logic: "If large buy, then front-run." They cannot feel "The Coil." They cannot sense "The Flow."

As a human, your edge is unpredictability.

- Bots assume trends will continue linearly.

- You know when a trend is a "fakeout" (The Wick Betrayal).

When you trade based on intuition and visual patterns rather than mathematical indicators, you often enter trades before the bot's algorithm triggers a "Buy" signal. You become the predator. You enter early. The bot sees the pump (caused by you) and FOMOs in after you. Now, the bot is your exit liquidity.

Contextual Link: This is the ultimate victory. Using your gut feeling to outsmart the algorithm. Learn how to harness this power in [The Science of Intuition].

Conclusion: Don't Feed the Parasites

The market is a dark forest. There are predators hiding in the code. You have two choices:

- Walk slowly, shout your position, and get eaten (Trade on slow DEXs with high slippage).

- Move silently, strike instantly, and vanish (Trade on Manic).

Speed isn't just about making money. It's about keeping it. Be faster than the code.

Ready to outrun the bots? Trade on the infrastructure built to protect your edge. 🌐 Official Website: Manic.Trade 🐦 X (Twitter): @ManicTrade 🎮 Discord: Join the Server ✈️ Telegram: Official Channel

🤖 Glossary: Terms You Need to Know

- MEV (Maximal Extractable Value)

- Plain English: Profit made by miners or bots by reordering, including, or censoring transactions within a block.

- Context: It's the technical term for "front-running" in crypto.

- Sandwich Attack

- Plain English: A predatory strategy where a bot buys a token just before you do (raising the price) and sells it just after you do (crashing the price).

- Result: You get a worse entry price, and the bot gets a risk-free profit.

- Front-Running

- Plain English: Jumping the line. Seeing a pending transaction and paying a higher fee to get yours processed first.

- Slippage Tolerance

- Plain English: The maximum amount of price change you are willing to accept between clicking "Buy" and the trade executing.

- Risk: High slippage settings act as a green light for MEV bots to give you a bad price.

Related Reading

This article is part of our comprehensive guide: The Speed Advantage: Why Sub-Second Execution Defines Modern Crypto Trading as well

Discover the three layers of execution speed (hardware 15%, UI 50%, blockchain 35%), why Solana's 400ms confirmation beats Ethereum's 12 seconds, and how infrastructure advantage captures 3-5x more profit than skill alone.