Key Takeaways

- Privacy by Default: Unlike Bitcoin, Monero hides the sender, receiver, and amount for every transaction automatically.

- Fungibility: XMR is the only major cryptocurrency where every coin is indistinguishable, preventing "tainted" coins from being blacklisted.

- Egalitarian Mining: Through the RandomX algorithm, Monero remains ASIC-resistant, allowing home users to mine with standard CPUs.

- Resilience: Despite regulatory pressure and exchange delistings, Monero remains the leading asset for financial sovereignty and censorship resistance.

What is Monero (XMR)? The Gold Standard of Privacy Coins

Monero (XMR) is a decentralized, open-source cryptocurrency launched in April 2014 with a singular, uncompromising mission: to serve as untraceable, decentralized digital cash. While mainstream blockchains like Bitcoin are often perceived as anonymous, they are actually "pseudonymous," meaning every transaction, wallet balance, and fund movement is recorded on a transparent public ledger. Monero disrupts this model by ensuring that financial privacy is not an option, but a mandatory, default setting for every user.

In an era where blockchain analysis firms can easily link wallet addresses to real-world identities, Monero provides a critical alternative for those seeking true financial confidentiality. Often referred to as the "gold standard" of Privacy Coins, it is designed to protect users from surveillance and capital controls.

The Core Philosophy: Privacy by Default

Unlike other assets such as Zcash, which offer optional privacy features, Monero enforces anonymity at the protocol level. This "privacy-first" architecture ensures that every transaction effectively obscures the sender, the recipient, and the exact amount being transferred. This creates a state of Fungibility—a property where every unit of the currency is indistinguishable from another. Because Monero tokens have no visible transaction history, they cannot be "tainted" or blacklisted by exchanges or merchants, a common risk associated with transparent assets.

📢 New Listing Alert: While centralized exchanges are delisting privacy, decentralized platforms are embracing it.We are proud to announce that $XMR is now live on Manic.Trade. You can now trade Monero Options and Long/Short positions directly on-chain.

How Monero Works: The Tech Behind Invisible Transactions

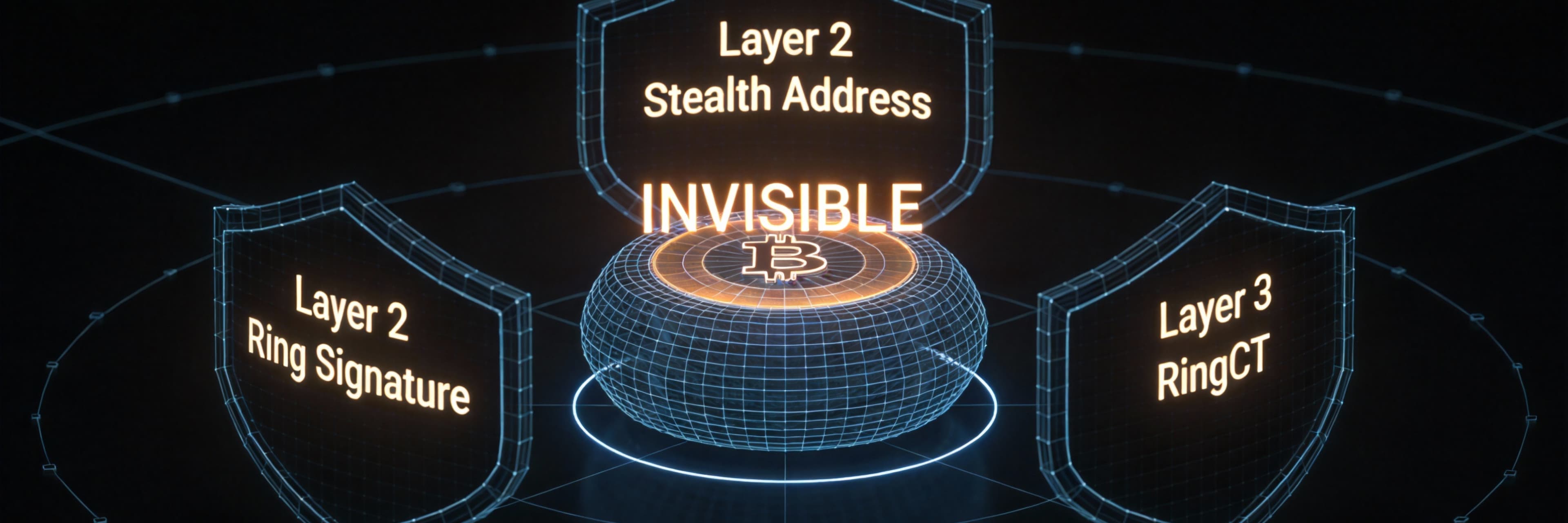

To understand the mechanics of Monero, one must look beneath the surface at its sophisticated cryptographic architecture. Monero functions as a triple-layer defense system that ensures every participant remains anonymous.

The Triple Pillars of Monero Privacy

- Ring Signatures (Hiding the Sender): This technology mixes a user’s transaction keys with a group of other users' keys from the blockchain. This creates a "ring" of possible signers, making it computationally impossible for an observer to determine which member initiated the transaction.

- Stealth Addresses (Hiding the Recipient): Monero employs a dynamic address system where every transaction generates a randomized, one-time destination address. Even if a user publishes their public wallet address, that address never appears on the blockchain.

- Ring Confidential Transactions / RingCT (Hiding the Amount): To prevent observers from analyzing wealth distribution, Monero uses RingCT. It utilizes mathematical proofs to verify that a transaction is valid without revealing the actual numerical values.

🛡️ Bitcoin vs. Monero Privacy Flow

| Feature | Bitcoin (BTC) | Monero (XMR) |

|---|---|---|

| Sender | Visible (Public Address) | Hidden (Ring Signatures) |

| Receiver | Visible (Public Address) | Hidden (Stealth Addresses) |

| Amount | Visible (Public Ledger) | Hidden (RingCT) |

| Traceability | Fully Traceable | Untraceable |

Beyond transaction data, Monero also focuses on hiding the physical footprint of its users. Through the Dandelion++ protocol, Monero masks IP addresses by passing transaction information through multiple layers of encryption and random routing between network nodes. This prevents "blockchain spies" from linking a specific transaction to a physical location.

Monero vs. Bitcoin: Why Privacy is the Ultimate Utility

While Bitcoin is often hailed as "digital gold," its transparency is increasingly viewed by privacy advocates as a double-edged sword. Bitcoin operates on a transparent blockchain where every transaction is an open book. In contrast, Monero treats privacy as a prerequisite for functional currency.

The Transparency Trap vs. Mandatory Privacy

The primary critique of Bitcoin is its "pseudonymity." Once a single transaction is linked to a real-world identity—through a KYC-compliant exchange or a delivery address—the entire history of that wallet becomes accessible. Monero solves this through mandatory privacy. According to industry analysis, this creates a "herd immunity" effect; because no transparent transactions are allowed, no single user stands out as "suspicious." This structural integrity is why Monero has seen significant price strength, even hitting milestones above $700 as users seek refuge from surveillance.

Fungibility: The Secret to Sound Money

The ultimate utility of Monero lies in fungibility. Because Bitcoin is transparent, individual coins can be "tainted" if they were previously used in a hack. Exchanges may freeze these coins, meaning one BTC might not be equal to another in terms of marketability. Monero (XMR) remains the only major cryptocurrency that is truly fungible. Since the history of an XMR token cannot be traced, every coin remains equal in value and utility.

The Future of Monero: XMR Price Predictions for 2026-2030

Predicting the long-term value of Monero requires a nuanced understanding of shifting global standards. Unlike transparent assets, Monero’s value proposition is tied directly to its utility as a fungible, private medium of exchange.

Medium-Term Outlook: 2026–2027

By 2026, the impact of Monero’s ongoing protocol enhancements is expected to solidify its market position. According to data models from Kraken, if Monero maintains a conservative annual growth rate of 5%, the price is projected to reach approximately $615.03 by 2026 and scale to $645.78 by 2027.

Long-Term Forecast: 2030 and Beyond

Looking toward the end of the decade, the XMR Price Prediction becomes more dependent on the global adoption of privacy standards.

- Conservative Estimate: A steady growth path would place XMR at approximately $747.57 by 2030.

- Bullish Expansion: Some analysts believe Monero has the potential to reach or exceed the $1,000 mark by 2030, provided it successfully navigates exchange delistings.

- Extended Projections: The compounding effect of a 5% annual growth rate could see XMR reaching $1,278.60 by 2041.

Regulatory Challenges: Can Monero Survive Global Bans?

The greatest threat to Monero today is not its underlying technology, but the intensifying Regulatory Scrutiny from global financial watchdogs.

The Global Crackdown: Delistings and Prohibitions

Major jurisdictions are increasingly moving to restrict the trading of privacy-centric assets.

- The Dubai Example: The Dubai International Financial Center recently imposed rules that prohibit the use of privacy coins for wide-ranging financial purposes, creating significant friction for institutional interaction with XMR.

- Exchange Delistings: Major centralized exchanges have frequently removed Monero to comply with local laws in the EU. This creates a "liquidity squeeze," making it harder for average investors to acquire the token through traditional on-ramps.

The Survival Outlook: Resilience vs. Restriction

Can Monero survive? Proponents suggest that these restrictions validate Monero's necessity as a hedge against overreach. Trading activity is expected to migrate toward decentralized exchanges (DEXs), ensuring the network remains operational even if it is "de-platformed" from the mainstream. As noted by experts, there is a global realization that privacy is critical to civilization.

Mining Monero: The Decentralized Edge of RandomX

While Bitcoin mining has evolved into an industrial arms race, Monero remains committed to egalitarianism through its RandomX algorithm.

The Power of CPU Mining and ASIC Resistance

The primary goal of RandomX is ASIC Resistance. In many other cryptocurrencies, specialized hardware creates a high barrier to entry, leading to hashrate concentration. Monero flips this script. RandomX is optimized for general-purpose CPUs found in home computers. By requiring features like floating-point operations and large L3 cache, it makes it economically unviable to build a specialized chip that outperforms a standard processor.

Systematic Evolution

The Monero ecosystem is built on a philosophy of proactive defense. To neutralize threats from manufacturers like Bitmain, the community is prepared to evolve the protocol:

- RandomX V2: Proposed updates aim to offer a 10-15% improvement in instruction efficiency for standard AMD and Intel CPUs.

- Decentralization: Because Monero is mined by thousands of individual participants globally, it is significantly more resistant to 51% attacks and censorship.

Is Monero a Good Investment in 2026 and Beyond?

As we look toward 2026, the investment thesis for Monero has shifted to a cornerstone asset for hedging against digital surveillance.

The Risk-Reward Ratio

The core appeal lies in its unique position. While Bitcoin captures the "digital gold" narrative, Monero is positioning itself as the "digital silver"—a more transactional, private alternative. Veteran trader Peter Brandt has even compared XMR’s price behavior to silver, suggesting it could be preparing for a massive breakout.

For the forward-thinking investor, Monero represents more than just a speculative asset; it is a long-term hedge against the erosion of financial privacy. While volatility is guaranteed, the fundamental necessity for private money suggests that Monero’s journey is only just beginning. For those comparing privacy coins like Zcash and Monero, XMR remains the dominant leader in network activity and developer commitment.

🚀 Enough Thinking, Start Trading: You know the tech. You know the risks. Now capitalize on the volatility.Manic.Trade offers the fastest, permissionless way to trade Monero price action. No KYC. No Delistings. Just pure on-chain execution.

FAQ

1. Is Monero illegal in the United States?

No, owning Monero is not illegal in the U.S. However, some centralized exchanges have delisted XMR to simplify their compliance with evolving AML/KYC regulations. Users can still legally acquire and hold Monero through decentralized platforms or peer-to-peer trades.

2. Can Monero transactions be traced by the IRS?

Monero is designed to be untraceable. While the IRS has offered bounties to firms that can "crack" Monero, there is currently no public evidence that the core privacy features (Ring Signatures, Stealth Addresses, and RingCT) have been compromised.

3. How does Monero maintain its value if it gets delisted?

Monero's value is driven by its utility as a private medium of exchange. Even if it is removed from centralized exchanges, its demand remains high in decentralized ecosystems and among users who require fungibility for real-world transactions.

4. Do I need special hardware to mine Monero?

No. Unlike Bitcoin, which requires expensive ASIC miners, Monero is specifically designed to be mined with standard computer CPUs. This keeps the network decentralized and accessible to everyday users.

5. What is the difference between "Pseudonymous" and "Anonymous"?

Bitcoin is pseudonymous; your name isn't on the ledger, but your "pseudonym" (wallet address) and all its history are public. Monero is anonymous; the sender, receiver, and amount are hidden by default, making it impossible to link transactions to an identity or a history.

Explore More Trading Resources

Solved your immediate problem? Go deeper:

- Trading Psychology Guide - Why discipline fails and how architecture solves it

- Momentum Trading Guide - Pattern recognition and execution frameworks

- Speed Advantage Guide - Infrastructure that multiplies edge

Browse all resources: Trading Tools & Resources Hub

Ready to trade with zero friction? → Start on Manic.Trade