Key Takeaways

- Technical Reality: The "Not Enough Money" error is a protective rejection triggered when your required margin exceeds your available free margin.

- Systemic Failure: Frequent encounters with this error indicate a flaw in your risk management—specifically over-leveraging or poor position sizing.

- Immediate Actions: You can resume trading by reducing lot sizes, closing existing positions, or adjusting account leverage via your broker’s dashboard.

- Long-term Solution: Professionalize your trading by shifting from "guessing" volumes to using mathematical models like the Fixed Percentage Method or the Kelly Criterion.

Encountering the mt4 not enough money error can be a frustrating experience, especially when you spot a high-probability setup and need to act fast. In technical terms, this message is a safeguard triggered by the MetaTrader 4 platform when your account lacks the necessary free margin to cover the initial costs of a new position. This error is not just a technical glitch; it is a critical signal that your current account equity is insufficient to support the specific lot size calculation you are attempting.

What Does 'Not Enough Money' Mean in MT4?

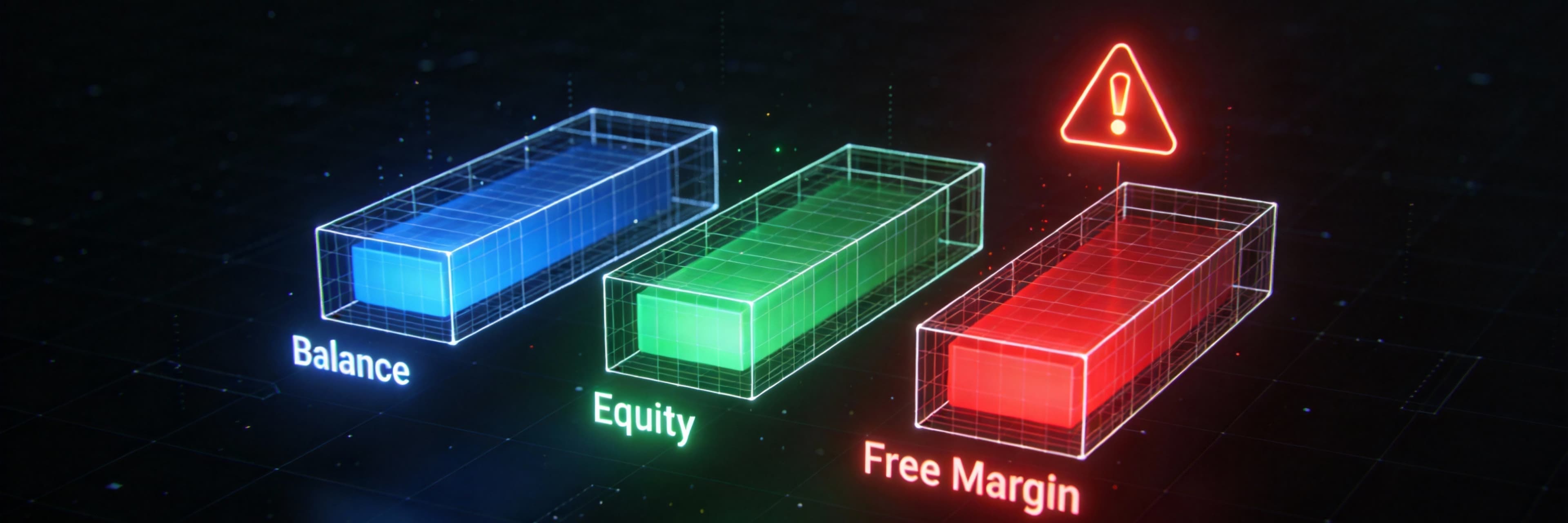

When you click "Buy" or "Sell," your broker’s server performs an instantaneous calculation. If the required margin plus the transaction costs (spread) exceeds your available funds, the order is rejected. To resolve this error, you must distinguish between three fundamental financial metrics displayed in your MT4 terminal:

- Balance: The total amount of closed profit/loss and deposits in your account. It does not account for currently open trades.

- Equity: Your balance plus or minus the floating profit or loss of your open positions. This represents the real-time value of your account.

- Free Margin: The difference between your equity and the margin held for open trades. This is the usable margin available to open new positions.

The "Not Enough Money" error occurs specifically when the margin requirement—the minimum deposit required by the broker to maintain a position—is higher than your current free margin. It serves as an immediate stop out level warning, reminding you that your automated trading (EA) or manual strategy is pushing against the boundaries of your available capital.

💡 Manic Reality Check: "Not Enough Money" is the broker's way of saying "We don't trust you anymore." In DeFi, trust is code. You don't need a broker's permission to trade; you just need a wallet. See the difference in DEX vs. CEX: Finding the Ultimate Battleground for Solana Scalpers.

Common Causes of the MT4 'Not Enough Money' Error

Understanding the specific triggers behind this error is the first step toward optimizing your trading system. From a diagnostic perspective, several factors contribute to this rejection:

1. Insufficient Free Margin and Leverage Constraints

Your leverage ratio determines how much capital your broker "lends" you. While high leverage increases risk, a low leverage ratio significantly increases the amount of margin required to hold a position. If your account settings are restricted to 1:30, you will trigger the error much sooner than on an account with 1:500 leverage. Furthermore, many brokers dynamically adjust margin requirements during periods of extreme volatility or major economic news, catching traders off guard.

2. Disproportionate Lot Size Calculation

A common mistake among retail traders is failing to adjust volume to their current account balance. Attempting to open a "Standard Lot" (100,000 units) on a small retail account without sufficient leverage will almost certainly trigger an execution error. This is often seen in automated trading (EA) scripts that are programmed with fixed lot sizes without checking cumulative margin requirements.

3. Hidden Costs and Account Liabilities

Sometimes the math on the screen doesn't seem to add up because of "hidden" deductions:

- Swaps and Commissions: Overnight interest rate differentials (swaps) and ECN commissions eat into your equity.

- Spread Fluctuations: The cost of the trade includes the spread. During low liquidity (like the New York-London rollover), spreads widen significantly, increasing the initial "cost" beyond your available free margin.

Immediate Technical Fixes to Resume Trading

If you need to regain control and resume trading activity immediately, follow these tactical steps to resolve margin bottlenecks.

1. Adjust Your Position Sizing

- Reduce Lot Size: If 1.0 lot is rejected, scale down to 0.1 or 0.01 lots. This immediately lowers the collateral required.

- Close Non-Essential Positions: Navigate to the "Trade" tab and close trades in profit or stalemate. This releases "locked" margin back into your free margin pool.

2. Optimize Account Leverage

If your strategy requires higher exposure, log into your broker’s client portal (not the MT4 terminal itself). Most brokers allow you to increase your leverage ratio instantly. Warning: While this "fixes" the error, it significantly increases your risk of a margin call.

3. Clear Platform Congestion

- Delete Corrupted Profiles: Go to File -> Open Data Folder, navigate to profiles, and delete unnecessary subfolders.

- Clear Global Variables: Press F3 to open the Global Variables window and delete outdated entries that might interfere with EA margin calculations.

- Check Firewall: Ensure Windows Defender Firewall is not blocking MT4's connection to the broker's server.

The Real Problem: Why Your Risk Management System is Failing

Seeing the error message mt4 not enough money is more than just a technical glitch; it is a systemic failure of your trading strategy. This error is a terminal symptom of a "lagging" risk model that prioritizes execution over preservation. As noted in professional circles, detection was never risk management; real management limits impact before the disaster happens.

The Illusion of Control

Many traders assume that because they have an automated system, the risk is managed. In reality, an EA without hard-coded free margin checks is just a faster way to reach a zero balance. Reliance on passive systems—like a mental list of risks—creates a gap between information and action. If you are "eyeballing" your position sizes, you are operating with the dangerous lag that leads to a margin call.

If you are seeing this error, you have moved from "managing risk" to "tolerating risk." You are no longer in the driver's seat; the broker's liquidity engine is. Treat this not as a nuisance, but as a fundamental mandate to redesign your risk governance from the ground up.

How to Calculate Correct Position Sizes to Avoid Margin Rejection

To move beyond this roadblock, you must transition to a mathematical framework for position sizing. By calculating your trade size based on risk rather than emotion, you ensure your account can withstand volatility without triggering a stop out level.

The Fixed Percentage Method

The most robust approach is risking 1% to 2% of your account balance per trade. Use this formula:

- Risk Amount: (Account Balance × Risk %)

- Value per Pip: (Risk Amount / Stop Loss in Pips)

- Lot Size: (Value per Pip / Value of 1 Pip for a Standard Lot)

Advanced Optimization: The Kelly Criterion

Some advanced traders use the Kelly Criterion to balance "edge" (win rate) against "payout" (win/loss ratio). The formula is: K = W - [(1 - W) / R]. Because markets are volatile, many professionals use a "Half-Kelly" approach—halving the calculated K value—to protect their available net equity.

Optimizing MT4 for Better Execution and Performance

Technical errors are often symptoms of broader systemic inefficiency. Optimizing MetaTrader 4 is about creating a high-performance environment where EAs can thrive without bottlenecks.

System Resource Management

MT4 is a 32-bit application with finite memory handling.

- Reduce Max Bars in History: Navigate to Tools > Options > Charts and lower "Max bars in history" to 5,000. This ensures the platform remains responsive for real-time calculations.

- Profile Management: Use the "Profiles" feature to group setups rather than running dozens of active charts, which taxes the CPU.

Professional Infrastructure

For algorithmic traders, local hardware is rarely sufficient.

- VPS Integration: A Virtual Private Server ensures your platform stays online 24/7, which is critical for maintaining stop out level protections.

- Managing the "Witching Hour": During the rollover (00:00 platform time), spreads widen. Adjust your EA settings to avoid trading during these low-liquidity gaps to ensure price transparency and avoid "not enough money" rejections caused by artificial spread spikes.

Conclusion: Turning a Technical Error into a Trading Edge

The mt4 not enough money error is a vital diagnostic signal. It serves as a forced pause, demanding that you audit the structural integrity of your trading plan. The difference between a retail gambler and a disciplined professional lies in the response: while a novice lowers their lot size to bypass the error, a professional uses it as a catalyst for a forensic review.

To turn this into a long-term advantage:

- Audit Margin Management: Maintain enough buffer to survive a "flash crash."

- Re-evaluate Leverage: If you see this error frequently, your leverage is likely too aggressive for your balance.

- Forensic Review: Use a structured trading journal to analyze if errors occur during emotional "revenge trading."

Ultimately, this error is a safeguard. It is the platform’s way of telling you that your current intent is mathematically unsustainable. Use this experience to sharpen your performance, refine your EA parameters, and build a resilient trading business. When you master your risk management system, you no longer fear the error message—you outgrow it.

FAQ

Q1: Why does MT4 say "Not Enough Money" when I clearly have a positive balance? A: MT4 checks your Free Margin, not your Balance. If you have open trades that are currently in a loss, or if the margin required for the new trade (plus the spread) exceeds your usable funds, the order will be rejected regardless of your total balance.

Q2: Can I fix this error by just increasing my leverage? A: Technically, yes. Increasing your leverage ratio reduces the amount of margin required to open a position. However, this is a "double-edged sword" as it also increases your risk of a total account wipeout if the trade moves against you.

Q3: Does the spread affect the "Not Enough Money" error? A: Absolutely. The "cost" of the trade includes the spread. During periods of low liquidity (like the New York-London rollover), spreads widen significantly. This spike in transaction costs can push the total margin requirement above your available free margin, causing a rejection.

Q4: How can I prevent my EA from triggering this error? A: You should code a "margin check" into your EA's logic. Ensure the script calculates the required margin for the intended lot size and compares it to the AccountFreeMargin() before sending an order request. Additionally, using a VPS can prevent execution delays that lead to price-related rejections.

Q5: What is the safest lot size to avoid this error? A: There is no "one-size-fits-all" lot size. It depends on your account equity and leverage. A safe approach is to use a Position Sizing Calculator and risk no more than 1-2% of your equity per trade, which naturally keeps your margin requirements within a healthy range.

Explore More Trading Resources

Solved your immediate problem? Go deeper:

- Trading Psychology Guide - Why discipline fails and how architecture solves it

- Momentum Trading Guide - Pattern recognition and execution frameworks

- Speed Advantage Guide - Infrastructure that multiplies edge

Browse all resources: Trading Tools & Resources Hub

Ready to trade with zero friction? → Start on Manic.Trade