Key Takeaways:

- Moltbot (formerly Clawdbot) represents a shift from passive AI to "agentic" AI capable of proactive task execution and system-level automation.

- Security Risks are High: Giving an LLM direct access to shell commands and private keys is "spicy" and potentially catastrophic without safeguards.

- Execution Layers are Essential: Manic.Trade acts as a critical safety buffer, managing API key security and preventing "hallucination-driven" financial losses.

- Human Oversight is Mandatory: You remain the strategic "pilot," utilizing AI as a co-pilot to handle data processing while you manage high-level risk and strategy.

From Clawdbot to Moltbot: The Rise of Agentic Trading

The landscape of artificial intelligence is shifting rapidly from passive assistants to proactive executors. At the forefront of this evolution is Moltbot trading automation, a tool that has captured the attention of the crypto community and tech enthusiasts alike. Originally launched as Clawdbot, the project recently underwent a high-profile rebranding after Anthropic, the creators of the Claude AI model, raised trademark concerns regarding the name and its resemblance to their "Clawd" mascot.

While the name has changed—a move creator Peter Steinberger likens to a lobster molting its shell to grow—the core mission remains the same: ushering in the era of agentic AI. This transition has been widely documented by tech publications, with Lifehacker explaining the fundamental shift from simple chat interfaces to functional agents.

Understanding the "Agentic" Shift

Unlike traditional generative AI or standard chatbots that simply respond to prompts with text, Moltbot is designed as an AI agent. This distinction is critical for traders looking to automate complex workflows. While a reactive AI might suggest a trading strategy, an agentic AI proactively pursues a goal across multiple steps with minimal human oversight.

The rise of Moltbot trading automation represents a departure from "business as usual" in the following ways:

- Proactive Execution: Instead of waiting for a user to trigger every move, agentic AI can independently manage on-chain automation tasks and monitor market conditions.

- Multi-Step Reasoning: Moltbot can handle complex agentic tasks, such as navigating file systems, organizing data, and interacting with various APIs to execute a broader strategy.

- Deep Integration: Users are reportedly purchasing dedicated hardware, such as Mac Minis, to give these agents full-system access, allowing them to operate as a persistent digital workforce.

- Cross-Platform Accessibility: Beyond a simple web interface, the bot can be managed via common messaging apps like WhatsApp or iMessage, making it a highly mobile solution for the modern trader.

Why the Rebrand Matters for Investors

The transition from Clawdbot AI agent to Moltbot is more than just a legal necessity; it marks the maturation of a tool that has already begun to disrupt traditional software expectations. As the "Chatbot Wars" intensify, the focus is moving toward who can provide the most utility within the crypto execution layer.

For those utilizing Moltbot trading automation, the goal is clear: leveraging the proactive nature of agentic AI to gain an edge in a 24/7 market. However, as these agents gain more autonomy over digital assets and sensitive information, the conversation naturally shifts from "what can it do?" to "how can we make it safe?" This is where understanding the art of momentum trading becomes essential—because even the most sophisticated AI can't protect you from executing the right trade at the wrong speed.

How Moltbot Automates Your Digital Life and Trades

Moltbot represents a paradigm shift from passive AI chatbots to active agentic AI, designed to bridge the gap between digital information and physical execution. Unlike standard Large Language Models (LLMs) that merely provide advice or generate text, Moltbot functions as a self-hosted, autonomous agent capable of interacting directly with a computer's operating system, local files, and external APIs. This "always-on" architecture allows it to handle complex agentic tasks that range from daily productivity to high-stakes crypto trading.

Technical Capabilities: Accessing Your Digital Ecosystem

At its core, Moltbot's power lies in its ability to execute shell commands and manage local environments. By integrating with the Model Context Protocol (MCP) and various messaging platforms like Telegram, Discord, and Slack, it serves as a centralized interface for your entire digital life. Users can discover and expand these capabilities through resources like the Awesome Moltbot Skills repository, which showcases the community-driven expansion of the bot's utility.

The technical versatility of Moltbot is evidenced by its capacity to perform the following operations:

| Capability Category | Specific Functions | Trading Relevance |

|---|---|---|

| File & System Management | Run scripts, monitor Docker containers, manage server directories | Execute automated trading scripts, monitor bot health |

| Persistent Monitoring | Heartbeat mechanism, cron integration, threshold alerts | Track price movements, trigger alerts on breakout patterns |

| Browser & API Automation | Navigate websites, access map/data APIs, order processing | Scrape exchange data, monitor social sentiment |

| Automated Communication | Email summarization, task creation, Slack notifications | Send trade confirmations, alert on position changes |

Bridging the Gap to Crypto Execution

For traders, the primary appeal of Moltbot trading automation is its ability to synthesize data from multiple sources—such as market sentiment from social media or technical indicators from APIs—and prepare for execution. Because it can store shared credentials (often via 1Password integrations) and bypass MFA through specialized bridges like Beeper, it can theoretically log into exchanges and place orders.

However, while Moltbot excels at the "thinking" and "orchestration" phases of a trade, it operates on a general-purpose computing layer. It is designed for persistence and lower latency in general automation, but it lacks the specialized financial safeguards required for high-frequency or high-security on-chain automation.

💡 Pro Tip: Speed Without Strategy is RecklessMoltbot can execute commands in milliseconds, but execution speed means nothing without proper risk controls. Before automating any trading workflow, establish hard limits on position size, maximum drawdown, and slippage tolerance. The fastest trade isn't always the smartest trade—especially when your AI can't distinguish between a momentum breakout and a liquidity trap.

While Moltbot can automate the "what" and the "when" of a trade, the "how" remains a significant security concern. Entrusting a general-purpose AI agent with direct access to exchange API key security or private keys introduces risks, as these agents operate with high-level permissions on local machines. This is where a specialized buffer becomes mandatory to prevent the "spicy" risks associated with autonomous system access.

The 'Spicy' Risks: Why Direct AI Trading is Dangerous

While the promise of Moltbot trading automation is revolutionary, the creators themselves often describe the tool as "spicy"—a charming euphemism for what security experts consider a high-stakes gamble. Entrusting a nascent, autonomous intelligence with direct access to your financial life involves trade-offs that go far beyond standard software risks. PCMag recently highlighted these security concerns, noting that the very features making the bot powerful also make it a potential liability.

The Vulnerability of Full Shell Access

The architectural choice that makes Moltbot so powerful is also its greatest liability. To perform complex agentic tasks, these bots often require full shell access to a user's computer. This creates a "lobster trap" scenario where the most compelling AI agent is also the most perilous. Giving an LLM the ability to read and write files or control a browser means that any hallucination or external manipulation could lead to catastrophic results.

For crypto traders, the dangers are specifically concentrated in three critical areas:

| Risk Category | Attack Vector | Potential Consequence |

|---|---|---|

| API Key Drainage | Compromised environment or prompt injection tricks bot into unauthorized trades | Funds drained through manipulated low-liquidity pairs |

| Black Box Execution | Lack of transparent reasoning for immediate actions | Catastrophic trades executed with no audit trail |

| Systemic Volatility | Multiple AI agents identify same sell signal simultaneously | Flash crashes amplified by automated selling cascade |

The Hidden Dangers of "Analysis Paralysis" in Reverse

Traditional traders suffer from overthinking. But AI agents introduce a new pathology: over-execution without reflection. While humans get paralyzed by too many indicators, AI can become trigger-happy, executing dozens of micro-trades based on noise rather than signal. This is the inverse problem—not because you're analyzing too much, but because your automation is doing too much without strategic oversight.

Adversarial AI and Market Manipulation

The risks are not just internal to the bot's logic; they are also external. Bad actors now deploy "adversarial AI" designed to feed false data into social feeds or create fake trading volume. Because on-chain automation relies on data inputs to make decisions, a sophisticated attacker can trick a bot into making unprofitable trades—a high-tech evolution of the traditional pump-and-dump scheme.

Directly connecting an LLM to your private keys or exchange APIs without a protective buffer is a recipe for financial disaster. This is precisely why a dedicated crypto execution layer is no longer optional. To navigate these "spicy" risks, traders must separate the "intelligence" (the AI agent) from the "execution" (the secure transaction layer). Manic.Trade integration serves as this vital firewall, ensuring that while the AI suggests the strategy, the actual execution remains within a secure, governed environment that protects your API keys and prevents unauthorized fund movement.

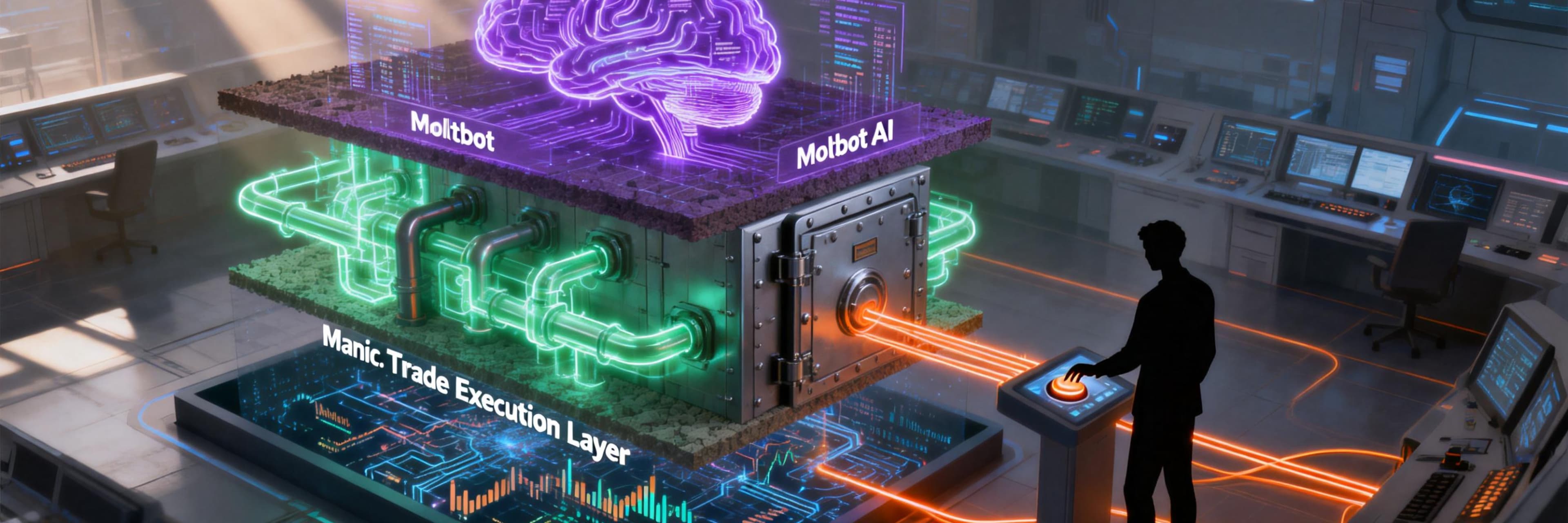

Why Moltbot Needs an Execution Layer like Manic.Trade

While Moltbot trading automation represents a frontier in autonomous AI, its architecture as a proactive "personal operating system" creates a unique set of requirements for financial transactions. Moltbot excels at high-level reasoning and background monitoring via its Heartbeat Engine, but it is fundamentally a general-purpose agent. To bridge the gap between AI reasoning and high-stakes crypto execution, a specialized layer like Manic.Trade is not just beneficial—it is essential for risk management and technical reliability.

The Bridge Between Reasoning and Execution

Moltbot operates as an Always-On Daemon, running locally on your hardware and interacting via messaging apps like Telegram. While it can execute shell commands and interact with APIs, granting an AI agent direct, unfettered access to your primary exchange API keys or private keys introduces significant "Grounding Errors" and security vulnerabilities.

Manic.Trade acts as the dedicated crypto execution layer that translates Moltbot's intent into precise on-chain actions. This separation of concerns ensures that while the Clawdbot AI agent identifies opportunities based on complex data analysis, the actual movement of funds happens within a controlled, optimized environment.

Key Benefits of the Manic.Trade Integration

| Benefit | Moltbot Alone | Moltbot + Manic.Trade |

|---|---|---|

| API Key Storage | Stored in general environment, vulnerable to prompt injection | Hardened vault with role-based permissions |

| Slippage Control | No native guardrails | Pre-defined limits prevent catastrophic execution |

| Transaction Speed | Fast API calls but no specialized routing | Optimized for sub-second on-chain settlement |

| Error Recovery | AI may retry failed trades indefinitely | Human-in-loop approval for anomalous conditions |

| Audit Trail | Limited logging of AI decisions | Complete transaction history with reasoning logs |

Manic.Trade allows users to set pre-defined limits on slippage, gas fees, and position sizes. Even if Moltbot experiences a "hallucination" or a logic error, the execution layer prevents the AI from making catastrophic financial mistakes.

⚡ Reality Check: Automation Isn't AbdicationThe phrase "set it and forget it" doesn't apply to crypto trading—it applies to slow cookers. Even with Manic.Trade's safety buffers, you must define clear risk parameters before granting execution permission. Think of it this way: Moltbot is your research analyst scanning 50 charts simultaneously, but you're still the portfolio manager who decides which trades align with your strategy. Never automate what you don't understand manually. Learn more about proper risk management systems before connecting any AI agent to live capital.

Transforming AI from a Tool to a Teammate

The transition from "reactive" tools to "proactive" agents means that your automation is constantly scanning the horizon. However, as the community has noted, the power of being "hackable and hostable on-prem" comes with the responsibility of securing your assets.

By using Manic.Trade as the execution buffer, you empower Moltbot trading automation to function as a true teammate. The AI handles the cognitive load—monitoring RSS feeds, analyzing price action via local LLMs, and managing content pipelines—while Manic.Trade handles the heavy lifting of secure, precise trade execution. This synergy allows tech-savvy traders to scale their strategies without sacrificing the API key security that is paramount in the volatile world of decentralized finance.

The Human Element: Why You Are Still the Pilot

In the world of aviation, even the most advanced aircraft equipped with state-of-the-art Safety Management Systems (SMS) and redundant hardware still require a pilot in the cockpit. The same principle applies to Moltbot trading automation. While the Clawdbot AI agent can handle the "agentic" heavy lifting—executing complex tasks on-chain and monitoring markets 24/7—it does not replace the need for a human pilot. You are the one who defines the mission, sets the risk parameters, and provides the strategic oversight that an algorithm cannot replicate.

Managing the "Human Factors" of Crypto Trading

In high-pressure environments, technical failure is rarely the primary cause of disaster; instead, it is often how humans react to pressure. In crypto, this manifests as "revenge trading" or ignoring risk protocols during high volatility. By using Moltbot trading automation integrated with Manic.Trade, you remove the emotional "noise" from the execution layer, but you must remain disciplined in your role as the strategist. Your objective is to use AI to amplify your strengths, deciding smarter and thinking faster rather than simply turning over total control.

This principle echoes the philosophy behind minimalist trading—sometimes the most powerful action is strategic inaction. AI can execute a thousand trades, but only you can decide when not to trade at all.

Your Responsibilities as the Strategic Lead

| Human Pilot Role | Moltbot AI Role | Manic.Trade Role |

|---|---|---|

| Define mission & target assets | Monitor markets 24/7 | Execute trades securely |

| Set risk limits & max drawdown | Synthesize multi-source data | Control slippage & gas fees |

| Recognize "black swan" events | Identify pattern opportunities | Provide transaction audit trail |

| Decide when to halt operations | Alert on threshold breaches | Enforce pre-defined safety limits |

To ensure your on-chain automation remains safe and effective, you must manage the following high-level "pilot" tasks:

- Defining the Mission: You decide which assets to target and what the ultimate goal of the trade is. Moltbot executes the "how," but you define the "why."

- Risk Management & Parameters: Just as a pilot checks weather patterns and fuel loads, you must set the hard limits for API key security and maximum drawdown. This isn't optional—proper risk management is what separates professionals from gamblers.

- Contextual Awareness: AI agents excel at following data patterns, but they lack the human ability to recognize when a specific market context—such as a "black swan" event—requires a total halt in operations.

- Resource Management: You are responsible for the crypto execution layer setup. This includes ensuring your Manic.Trade integration is properly configured to act as the "air traffic control" for your AI's orders.

Experience in trading is not about doing more with less margin; it is knowing when to slow down, adjust the strategy, or stop entirely. By viewing yourself as the pilot and Moltbot as your highly capable co-pilot, you create a synergy where agentic tasks are handled with machine precision while being guided by human wisdom and strategic discipline.

Setting Up Your Moltbot + Manic.Trade Workflow

Integrating Moltbot trading automation into your financial strategy requires moving beyond simple "vibe coding" toward a robust, production-grade architecture. While Moltbot excels at processing complex instructions and orchestrating agentic tasks, it lacks the native financial guardrails required for high-stakes crypto execution. To bridge this gap, establishing a secure link between Moltbot's intelligence and Manic.Trade's execution layer is essential.

The Conceptual Architecture

A high-level setup involves positioning Moltbot as the "Brain" and Manic.Trade as the "Hands." For a trading workflow, this means Moltbot monitors market sentiment or technical data, while Manic.Trade handles the on-chain automation and liquidity routing. The community has seen a viral rise in self-hosted assistants like Moltbot, but the transition to financial execution requires a more disciplined approach.

To build a secure, automated trading setup, follow these integration steps:

- Define the Communication Interface: Set up Moltbot via a dedicated channel (such as Telegram or a macOS menu bar app) to act as your primary command console. This allows you to "talk" to your trading bot and receive real-time summaries of market movements.

- Configure Agentic Task Parameters: Use Moltbot to parse complex data—such as scanning social sentiment or developer activity on GitHub—to identify potential trading signals.

- Establish the Execution Bridge: Instead of granting an AI agent direct access to your primary private keys, connect Moltbot to Manic.Trade via API. This ensures API key security by utilizing Manic.Trade's specialized infrastructure to sign transactions and manage slippage.

- Implement a Human-in-the-Loop (HITL) Check: For high-volume trades, configure Moltbot to send a "Proposed Trade" notification to your Slack or Telegram. You can then approve the execution, which Moltbot triggers through the Manic.Trade crypto execution layer.

Why Manic.Trade Integration is Non-Negotiable

While Moltbot is recognized as "the AI that actually does things," the volatile nature of the crypto markets demands a dedicated execution partner. Manic.Trade integration provides the necessary "Proof of Execution" and risk management that a general-purpose AI agent cannot provide alone. This sentiment is echoed in discussions on Hacker News, where developers often debate the balance between AI autonomy and system security.

By offloading the actual trade placement to Manic.Trade, you protect your assets from the "spaghetti code" errors often associated with early-stage AI prototyping. The primary goal is to leverage Moltbot for its analytical power while relying on Manic.Trade for secure, precise, and verifiable on-chain settlements. This synergy creates a professional-grade automated desk capable of reacting to market shifts 24/7 without compromising security.

🎯 Master the Fundamentals FirstBefore integrating any AI trading system, master the manual execution process on Manic.Trade. Understand how order types work, test slippage scenarios with small positions, and familiarize yourself with the platform's risk management tools. Only after you've proven your strategy works manually should you consider automation. AI amplifies your edge—but it also amplifies your mistakes.

FAQ

What is the difference between Clawdbot and Moltbot?

Moltbot is the rebranded version of Clawdbot. The change was made primarily due to trademark concerns from Anthropic (creators of Claude AI). The functionality remains the same: it is an agentic AI designed to perform tasks directly on your computer or through APIs.

Is Moltbot trading automation safe to use on my main computer?

The creators warn that Moltbot is "spicy" because it requires high-level system access to perform its tasks. For trading, it is highly recommended to use a dedicated execution layer like Manic.Trade to avoid giving the AI direct access to your private keys or primary exchange accounts.

Do I need to know how to code to use Moltbot and Manic.Trade?

While some technical knowledge helps (especially for self-hosting on a Mac Mini or Raspberry Pi), Moltbot is designed to be managed via natural language through apps like Telegram or Slack. Manic.Trade provides a user-friendly interface to manage the actual trade execution.

Can Moltbot trade 24/7 without my intervention?

Yes, Moltbot is an "always-on" agent. However, for security reasons, it is best practice to implement a "Human-in-the-Loop" system where the bot identifies opportunities and you provide the final approval for execution via a mobile notification.

Why can't I just use Moltbot's built-in browser to trade on exchanges?

Using a general-purpose AI agent to log into financial accounts directly exposes you to risks like session hijacking, prompt injection, and hallucination-led errors. Manic.Trade provides a hardened, purpose-built environment specifically for financial transactions, which is much safer than a standard browser automation script.

Start Trading Smarter with Manic.Trade

Ready to combine AI intelligence with secure execution? Manic.Trade gives you the speed and safety you need to automate crypto trading without the "spicy" risks.

Join the Manic.Trade Community:

🌐 Official Website: Manic.Trade

🐦 X (Twitter): @ManicTrade

🎮 Discord: Join the Server

✈️ Telegram: Official Channel

Experience the platform built for speed, designed for security.

Explore More Trading Resources

Solved your immediate problem? Go deeper:

- Trading Psychology Guide - Why discipline fails and how architecture solves it

- Momentum Trading Guide - Pattern recognition and execution frameworks

- Speed Advantage Guide - Infrastructure that multiplies edge

Browse all resources: Trading Tools & Resources Hub

Ready to trade with zero friction? → Start on Manic.Trade